You only need one stock

What everyone gets wrong about diversification, reinvested dividends, and Warren Buffett

The funny thing about you being a great stock picker is that you will end up with a huge position in a wonderful company if you do it right. There is nothing wrong with that.

But can you sleep well at night? Owning only Apple or Costco?

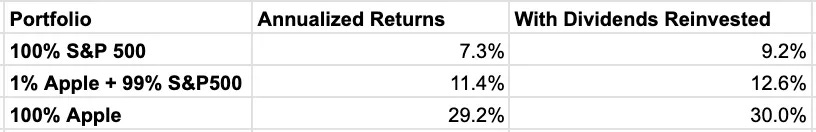

A couple of weeks ago, we looked at the hypothetical example of someone investing 1% of their $10,000 portfolio in Apple, in September 1997, the day Steve Jobs came back as CEO; with the remaining 99% in the S&P 500.

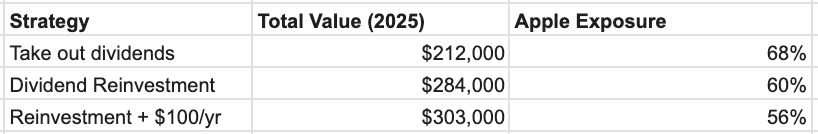

Your $100 in Apple would have turned into $139k, while your $9,900 in the S&P 500 turning into about $73k, for a total of $212k. In comparison, investing $10,000 in the S&P 500 would have turned to about $73k today.

While it would have been a life changing investment with only 1% of capital at risk at the time. Today, Apple would constitute 66% of this hypothetical portfolio and since Apple is 6% of the S&P 500, the total exposure would be about 68%.

I wouldn’t be able to sleep well at night having that much of my portfolio in a single stock trading at 36X earnings with limited growth.

There’s a simple way this problem could have been alleviated. Instead of taking the dividend payments out of the portfolio, they could have been reinvested. Then, the total investment in Apple would have been $164k for a total of $284k, with a total exposure of a little less than 60%.

Is there a way to bring it further down? Yes.

And the secret is in how reinvested dividends work.

Do dividends make up one-third of returns?

Over that 28 year period, reinvested dividends contributed to an extra $72k returns ($284k instead of $212k) or 33% more.

Does this mean that 1/3 of returns come from dividends?

The secret is not in the dividends themselves. But in the reinvestment of the dividends.

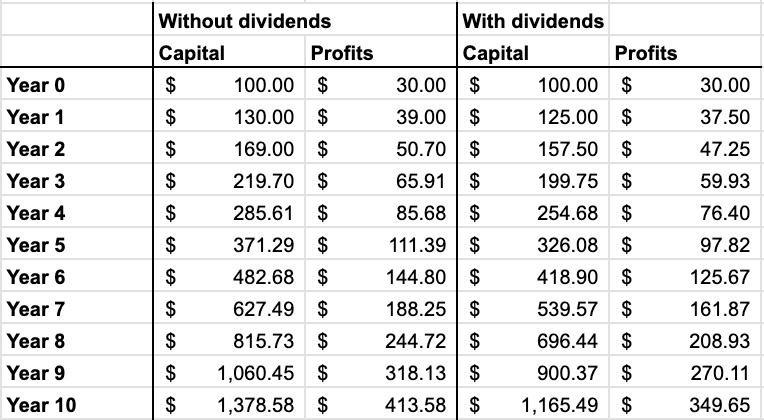

Let’s say a business generates $30 in profits from every $100 of capital. If it reinvests everything into the business, it will have $130 of starting capital and will generate $39 in profits the following year. It can keep reinvesting at high rates. If instead, it pays $5 in dividends, it will have starting capital of only $125 with profits of $37.50 after one year.

After 10 years, the annual profits are 18% higher if they were fully reinvested.

This is compound interest working.

And you have to do just like this company by reinvesting into your portfolio.

But the reinvestment doesn’t have to come just from dividends for you to maximize your returns. In fact, dividends might not be the best way to reinvest since you have to pay taxes on them before you can do the reinvesting. And as we saw in the example above, sometimes, it is best for the company to do the reinvesting for you, especially if it has high returns on capital.

Your cash doesn’t care where it is coming from. And this is the secret as to how you can have a diversified portfolio with only one stock. You need constant cash flows that you can reinvest in your portfolio.

Consistency is key

Coming back to the Apple example. You invested 1% of your portfolio because you made a bet on Steve Jobs. It was a small but worthy risk. What if you kept investing every year?

Even a small investment of $100 (which is one percent of the original portfolio) can make a big difference long-term. Let’s say you invested $100 every year on the anniversary of that first investment in the S&P 500. Your total investment would be worth $303k1 today with your exposure to Apple (same $164k with 6% of the S&P 500 in Apple) about 56%.

You didn’t take any additional risk. You invested in the S&P 500, regardless on how well it was doing. You invested during the Dotcom boom as well as the turmoil of the Great Recession. But you lowered your exposure to your one stock investment, Apple, from 68% to 56%. And all that with $100 a year and reinvesting dividends. Imagine what you could do with $100 a month.

This is how Warren Buffett built Berkshire Hathaway into a trillion dollar company. It is more than just him being a great stock picker. He had constant cash flows to invest through the insurance float.

This is how Buffett did it

Warren Buffett stopped buying shares of Coca Cola (KO 0.00%↑) in 1994. It was 43% of the total equity (24% of assets) of Berkshire Hathaway at the time and worth $5.1 billion. Today, the same shares of Coca Cola are worth $26.5 B but only 3.7% of equity (2% of assets).

This is what enabled Warren Buffett to have such a long career as an investor. Most professional investors need to keep looking for clients to get more cash to invest. Buffett didn’t have this problem as he was getting the cash for free. Of course, he owned wonderful insurance and reinsurance businesses.

You don’t have to be as great as Warren Buffett. You don’t even need to be a good stock picker. You don’t need to be a full-time investor. You just need to constantly invest. Every month, or every year, a small contribution from your income into your investment portfolio can make a huge difference long-term. And you don’t have to think of selling or diversification when your position gets too big because you have constant cash flows to buy new positions.

I used Grok, Gemini, and ChatGPT to come up with this answer as calculating it myself would be too time consuming. They did not give the same answer, although they were all close. I took the most plausible one based on the numbers and method used. What matters is that the $100 yearly investment turned into about $10k in 28 years.

Interesting post, as always.

Apologies for the off-topic comment, but I find it curious and comforting that when you assign tasks to AIs, you assign them to multiple AIs and then compare the results for verification.

I think that, given the current state of artificial intelligence, this is the perfect approach for having these systems perform computations or tasks that would otherwise be impossible if attempted manually.